As a mortgage specialist serving North County San Diego, one of the common questions I hear is, “What exactly goes into my credit score?” and “How can I improve it before applying for a home loan?”

Your credit score plays a major role in determining your loan options, interest rate, and overall affordability. The good news is credit is predictable, improvable, and often misunderstood. When you understand how lenders evaluate credit, you can take smart steps that make a real difference.

Let’s break it down.

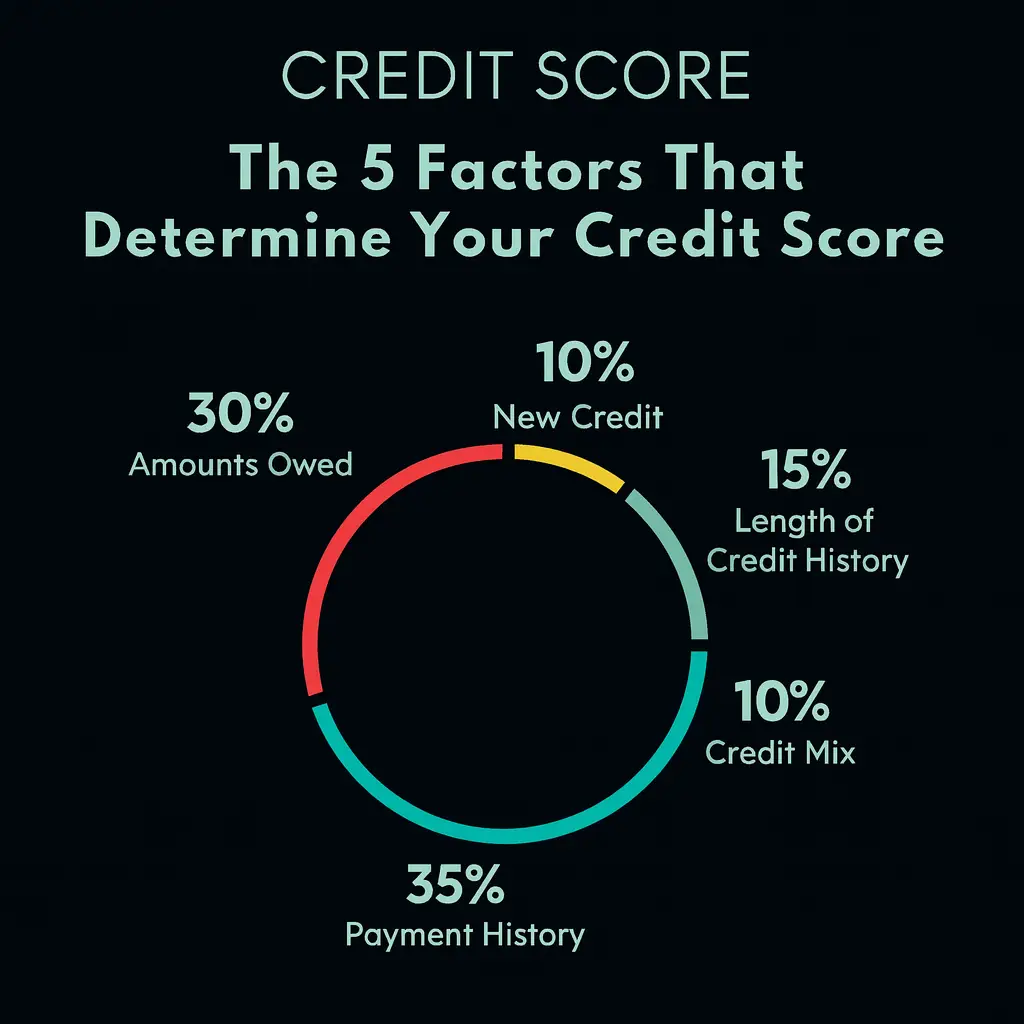

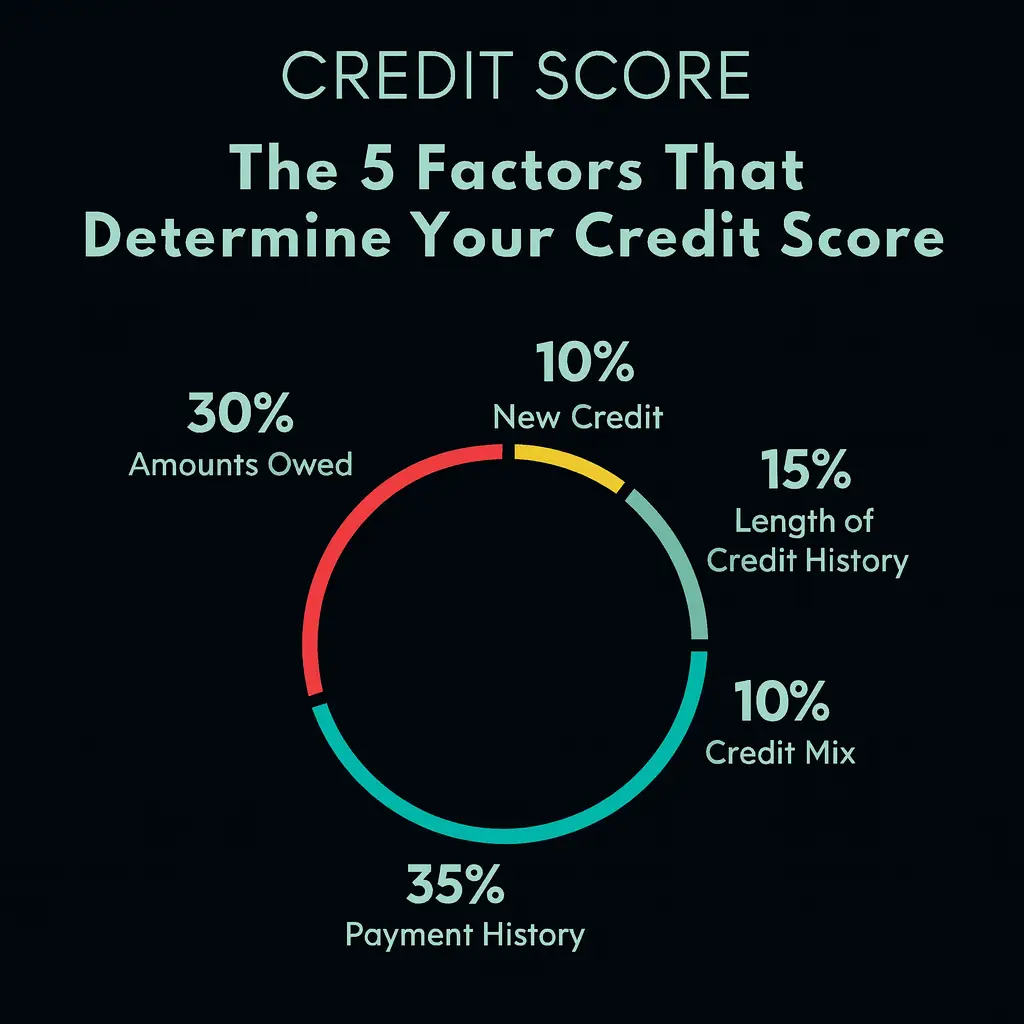

The 5 Factors That Make Up Your FICO® Score

FICO® Scores are built from five categories of information found in your credit report. Each category carries a different level of importance:

| Category | Weight | What It Means |

| Payment History | 35% | Whether you’ve paid past accounts on time |

| Amounts Owed (Utilization) | 30% | How much of your available credit you’re using |

| Length of Credit History | 15% | How long your accounts have been open |

| New Credit | 10% | How often you apply for new credit |

| Credit Mix | 10% | The variety of credit types you use |

Every borrower’s profile is unique, so the impact of each category can vary but these percentages give you a solid roadmap.

1. Payment History (35%) – The Heavy Hitter

This is the single most important part of your score. Lenders want to see a track record of paying bills on time because it’s the strongest predictor of future repayment. A late payment or two won’t destroy your score but not making a payment for 30 days or more past the due date will hurt. Consistent on‑time payments are the foundation of strong credit.

What counts as payment history?

- Credit cards & Retail store cards

- Mortgages & Auto loans

- Public records (bankruptcies, collections)

How to improve this category

- Set up automatic payments for at least the minimum due.

- Catch up on any late accounts older delinquencies matter less over time.

- Communicate with creditors if you’re struggling, many offer hardship options.

- Consider credit counseling if budgeting or debt management feels overwhelming.

2. Amounts Owed (30%) – Your Credit Utilization

This category isn’t about how much debt you have, it’s about how much of your available credit you’re using.

The Credit Utilization Sweet Spot

Most experts recommend keeping revolving utilization below 30%, but below 10% is ideal for top-tier scores. Even if you pay your cards in full each month, the balance reported on your statement date may still show up, so timing matters.

What FICO looks at:

- Total balances across all accounts

- Balances on specific types of accounts

- Number of accounts with balances

- How much of installment loans you’ve paid down

- Your utilization ratio on revolving credit

How to improve this category

- Pay down balances before the statement closes, not just before the due date.

- Spread balances across multiple cards instead of maxing out one.

- Ask for a credit limit increase without increasing spending.

- Avoid closing old credit cards, which can shrink your available credit.

3. Length of Credit History (15%) – Time Builds Trust

A longer credit history gives lenders more data to evaluate your habits.

FICO considers:

- Age of your oldest account

- Age of your newest account

- Average age of all accounts

- How long it’s been since you used certain accounts

How to improve this category

- Keep old accounts open, even if you rarely use them.

- Avoid opening too many new accounts, which lowers your average age.

- Use older cards occasionally to keep them active.

4. New Credit (10%) – Slow and Steady Wins

Opening several accounts in a short period signals risk, especially for borrowers with shorter credit histories.

How to improve this category

- Limit hard inquiries (credit checks) when preparing for a mortgage.

- Rate shop smartly, multiple mortgage or auto inquiries within a short window typically count as one.

- Avoid opening new credit cards right before applying for a home loan.

5. Credit Mix (10%) – Variety Helps

FICO likes to see that you can manage different types of credit responsibly. You don’t need every type of credit, but a healthy mix can help.

Examples include:

- Credit cards

- Auto loans

- Mortgages

- Retail accounts

- Installment loans

How to improve this category

- Don’t open accounts just for the sake of “mix.”

- If you’re building credit, a secured card or credit-builder loan can help diversify responsibly.

How Your Credit Score Changes Over Time

Your credit score isn’t static. It evolves as:

- Balances change

- Accounts age

- New information is reported

- Negative items age off your report

Because of this, there’s no exact formula for how much a single action will raise or lower your score but consistent positive habits always win.

Practical Tips to Boost Your Score Before a Mortgage Application

Here’s what I recommend to clients preparing to buy or refinance:

- Pay every bill on time, or 5 days early, no exceptions – One 30‑day late payment can sting.

- Keep credit card balances low – Under 30% utilization is good… under 10% is excellent.

- Don’t close old accounts – They help your average age and total available credit.

- Avoid opening new credit – Especially in the 3 to 6 months before applying.

- Check your credit report for errors – Dispute inaccuracies with the bureaus, mistakes happen more often than you’d think. (Check as often as once a year here for free: AnnualCreditReport.com)

- If you’ve had past issues, focus on consistency – Time heals most credit wounds.

Final Thoughts: Credit Is a Tool – Not a Judgment

Your credit score is simply a snapshot of how you’ve managed credit over time. It’s not a measure of your character, your financial potential, or your ability to become a homeowner. With the right strategy, nearly anyone can improve their score and position themselves for better mortgage options.

If you’d like a personalized credit review or guidance on preparing for a VA loan, conventional loan, or refinance, I’m always here to help. Strong credit opens doors and I’m here to help you walk through them.