Refinancing your home isn’t just about chasing a lower rate. It’s about making your mortgage work better for your life. Whether you want to reduce your monthly payment, drop PMI, pay off your loan faster, or pull cash out for something big—refinancing can help you do it.

If you own a home in Carlsbad, Encinitas, or anywhere in North County San Diego, now might be the perfect time to explore your options. Here’s what you need to know.

What Is Refinancing?

Refinancing means replacing your current mortgage with a new one—usually to improve your financial position. You can refinance to get a lower interest rate, change your loan term, switch from an adjustable to a fixed rate, remove PMI, or access your equity.

It’s not a one-size-fits-all move, and the right refinance depends on your specific goals.

5 Common Reasons to Refinance

1. Lower Your Monthly Payment

If rates have dropped since you bought your home, refinancing could cut hundreds off your monthly payment. Even if rates haven’t dropped much, if your credit has improved, you might still qualify for better terms.

2. Remove PMI

If you bought with less than 20% down, you’re likely paying Private Mortgage Insurance (PMI). Once you’ve built enough equity, you can refinance to remove it and keep more money in your pocket every month.

3. Tap Into Your Home Equity

Through a cash-out refinance, you can turn home equity into cash for home improvements, debt consolidation, or other financial goals. This is often cheaper than personal loans or credit cards.

4. Shorten Your Loan Term

Want to pay off your mortgage faster and save on interest? Refinancing from a 30-year to a 15-year loan could help you build equity quicker and pay significantly less in long-term interest.

5. Switch to a Fixed Rate

If you have an adjustable-rate mortgage (ARM), refinancing to a fixed rate can give you peace of mind with a stable monthly payment, especially in uncertain markets.

Is Refinancing Worth It Right Now?

If your home is in Carlsbad or Encinitas, chances are it has appreciated in value. That means more equity and more refinancing power.

Even if interest rates have ticked up from recent lows, many homeowners are still refinancing to remove PMI, consolidate debt, or change loan terms. It’s all about your personal goals.

Use this Find My Best Mortgage tool to see which refinance options make the most sense for your situation.

What You’ll Need to Refinance

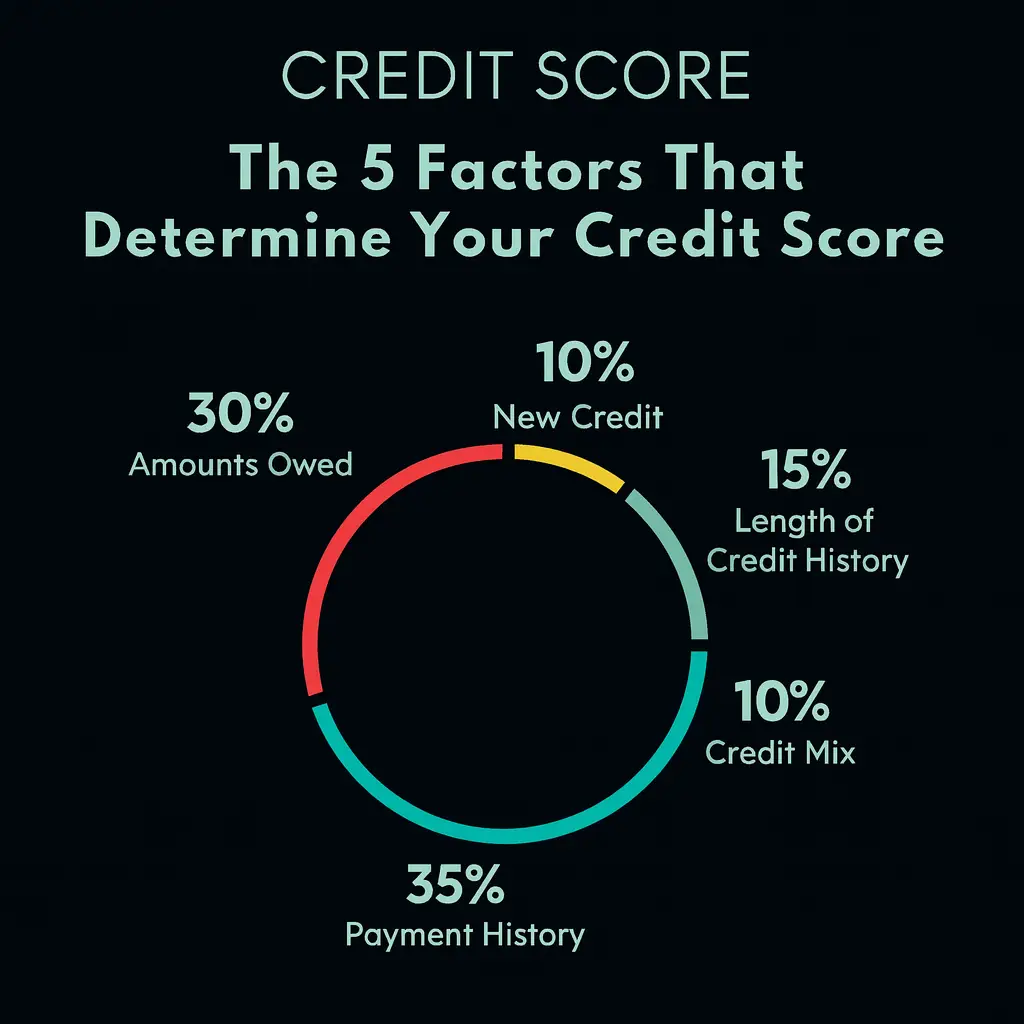

- A good credit score (typically 620+ for conventional refis)

- Enough equity (usually 20% for cash-out or PMI removal)

- Proof of income and assets

- A recent home appraisal

Working with a mortgage specialist like Mark Pattison ensures the process is smooth, transparent, and tailored to your goals.

How Much Could You Save?

Refinancing could save you hundreds per month—or tens of thousands over the life of your loan. It depends on your current loan, rate, and how long you plan to stay in your home.

Want a quick idea of your potential savings? Schedule a free consultation with Mark Pattison to talk through your numbers.

Get Expert Guidance from Mark Pattison

Mark W. Pattison is a Mortgage Loan Specialist with C2 Financial, proudly serving Carlsbad, Encinitas, and the surrounding San Diego area. Whether you’re refinancing for a lower payment, dropping PMI, or taking cash out—Mark will walk you through the best options.

Apply Now to get started or visit mwpattison.com to explore more mortgage solutions tailored to your needs.

Refinancing isn’t just about saving money—it’s about gaining control. Let’s make your mortgage work for you.