DSCR Loans and Refinancing to Remove PMI

If you’re a homeowner or real estate investor in Carlsbad, Encinitas, or anywhere in North County San Diego, you’ve got smart options when it comes to financing. Whether you want to expand your rental portfolio or cut unnecessary monthly costs, two strategies worth exploring are DSCR loans and refinancing to remove PMI. These options can make a major difference in your bottom line.

What Is a DSCR Loan?

A DSCR loan (Debt Service Coverage Ratio loan), also known as an Investor Cash Flow loan, allows real estate investors to qualify based on the rental income of a property—not personal income. Instead of W-2s or tax returns, lenders look at how well the property’s rent covers the mortgage payment.

For example, if a property in Carlsbad rents for $3,000 and your monthly housing expense is $2,400, the DSCR would be 1.25. That’s strong enough to qualify in most cases.

Who Should Consider a DSCR Loan?

Ideal for:

- Self-employed investors

- Buyers using LLCs to hold property

- Investors expanding rental portfolios

- Anyone with complex or hard-to-document income

In markets like Carlsbad and Encinitas, where property values and rent potential are high, DSCR loans give you flexibility and speed without the hassle of traditional income documentation.

Find My Best Mortgage to explore investment property financing that works for your situation.

DSCR Loan Benefits

Here’s what stands out:

- Qualify based on rental income

- No personal income verification

- Fewer documents needed

- Fast closings and scalable options

- Works for both purchases and refinances

Keep in mind: DSCR loans often require at least 20–25% down and have slightly higher rates. But if your goal is long-term cash flow and portfolio growth, they’re a powerful tool.

Apply Now to see if a DSCR loan could help you buy or refinance your next rental property.

What You’ll Need to Qualify for a DSCR Loan

- A property with solid rental income (typically a 1.25 DSCR or better)

- 20–25% down payment or equivalent equity if refinancing

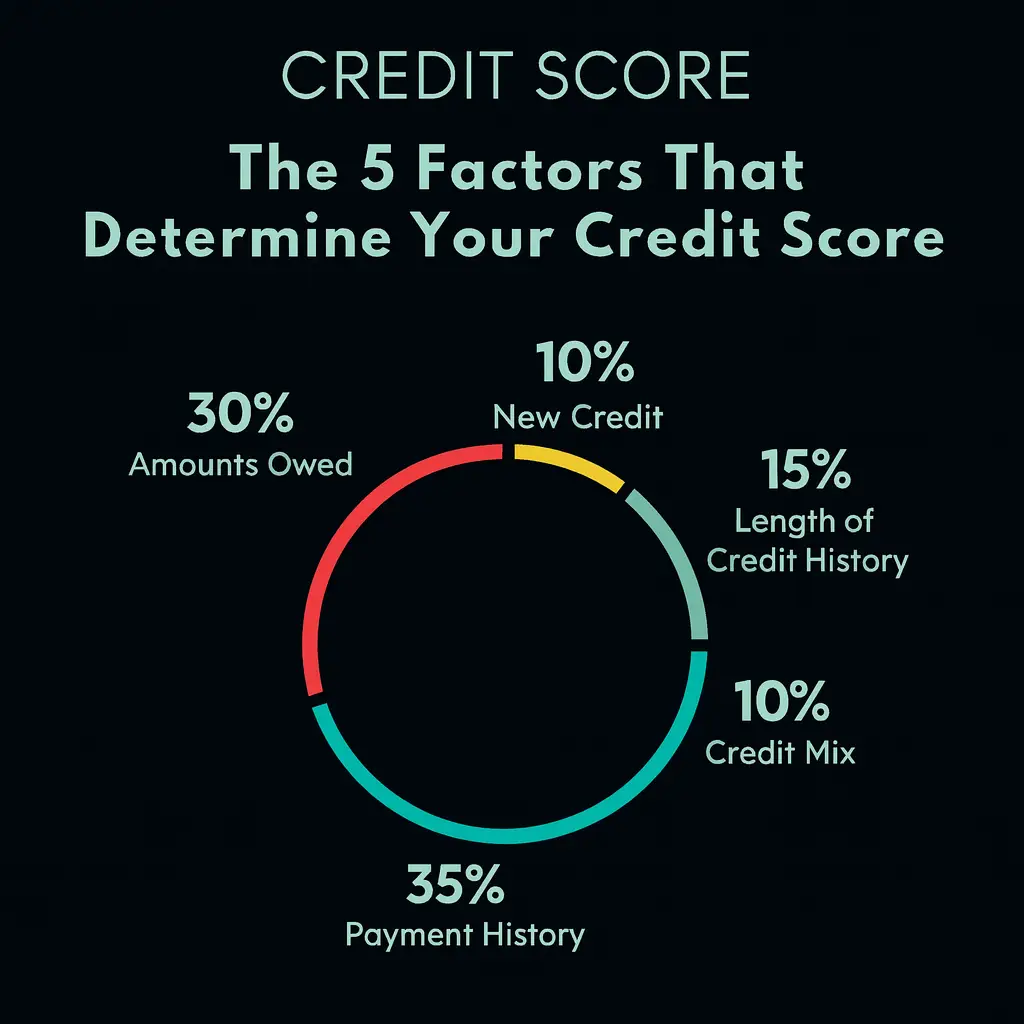

- A credit score in the mid-600s or higher

- 3–6 months of mortgage payments in reserves

- A rent-ready property used strictly for investment (not primary residence)

If you’re not sure whether a property you’re eyeing in Encinitas or Carlsbad qualifies, you can schedule a quick consultation here and I’ll walk you through it.

Refinancing to Remove PMI

If you bought your home with less than 20% down, you’re probably paying Private Mortgage Insurance (PMI). While PMI may have helped you purchase, it’s not meant to be permanent—and removing it could save you hundreds each month.

Why Remove PMI?

PMI typically costs between 0.5% and 1% of your loan per year. On a $700,000 mortgage in North County, that could mean $300 to $500 or more in extra monthly payments. This money doesn’t build equity or improve your home—it just protects the lender.

By refinancing, you can drop PMI entirely once you have 20% or more equity. With home values rising in Carlsbad and Encinitas, that milestone might be closer than you think.

How to Remove PMI

Two ways to eliminate it:

1. Request cancellation

Once you owe less than 80% of the original purchase price, you can ask your lender to remove PMI. They’re legally required to cancel it at 78%.

2. Refinance your mortgage

If your home has appreciated and you now have 20% equity, refinancing into a new loan without PMI can cut your monthly costs immediately—and possibly get you a better interest rate.

Signs You Might Be Ready

- You’ve built at least 20% equity in your home

- Your credit score and income have improved

- Interest rates are favorable

- You plan to stay in your home long enough to make refinancing worthwhile

Find My Best Mortgage to see your personalized refinance options or Apply Now to get the process started.

Why Carlsbad and Encinitas Are Perfect for Strategic Financing

These coastal cities are known for high home values, strong rental demand, and consistent appreciation. That means better cash flow potential for investors and faster equity growth for homeowners. Whether you’re looking to build wealth or simply save money, the right mortgage strategy makes all the difference.

Let’s Talk About What’s Possible

I’m Mark W. Pattison, a Mortgage Loan Specialist serving Carlsbad, Encinitas, and all of North County San Diego. If you’re thinking about refinancing to remove PMI or exploring DSCR financing for your next investment property, let’s connect.

Schedule Your Free Consultation

Apply Now

Visit My Homepage

The right mortgage plan starts with a conversation.