Understanding Your FICO® Score – What Mortgage Lenders Really Look For and How to Improve Yours

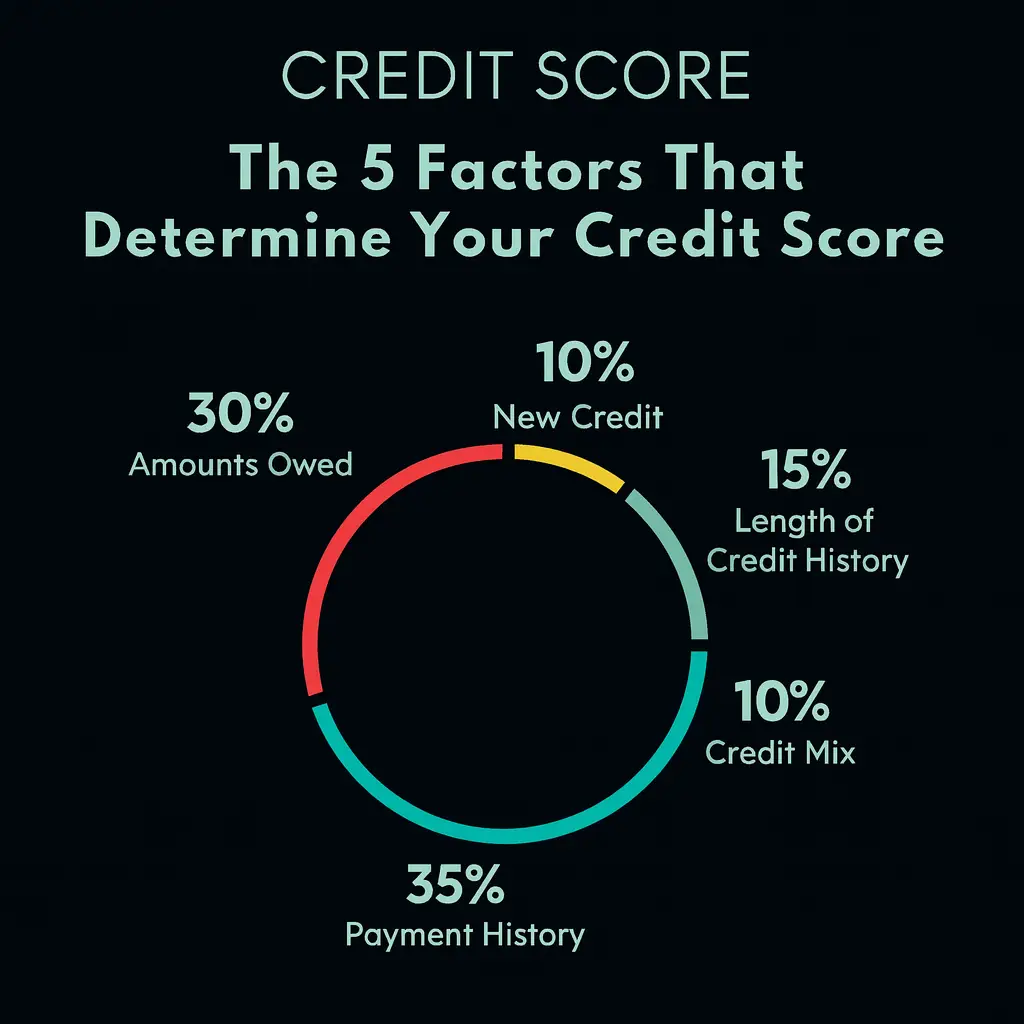

As a mortgage specialist serving North County San Diego, one of the common questions I hear is, “What exactly goes into my credit score?” and “How can I improve it before applying for a home loan?” Your credit score plays a major role in determining your loan options, interest rate, and overall affordability. The […]

Why Getting Pre-Approved Matters in Today’s Market

If you’re planning to buy a home in Carlsbad, Encinitas, or anywhere in North County San Diego, one of the smartest moves you can make is getting pre-approved for your mortgage. In a competitive market, pre-approval isn’t just helpful—it’s essential. Here’s why it matters, how it works, and how to get started. What Is Mortgage […]

Is Now a Good Time to Refinance in Carlsbad or Encinitas?

Refinancing your home isn’t just about chasing a lower rate. It’s about making your mortgage work better for your life. Whether you want to reduce your monthly payment, drop PMI, pay off your loan faster, or pull cash out for something big—refinancing can help you do it. If you own a home in Carlsbad, Encinitas, […]

How to Use DSCR Loans and Refinance to Remove PMI in Carlsbad & Encinitas

DSCR Loans and Refinancing to Remove PMI If you’re a homeowner or real estate investor in Carlsbad, Encinitas, or anywhere in North County San Diego, you’ve got smart options when it comes to financing. Whether you want to expand your rental portfolio or cut unnecessary monthly costs, two strategies worth exploring are DSCR loans and […]