Understanding Your FICO® Score – What Mortgage Lenders Really Look For and How to Improve Yours

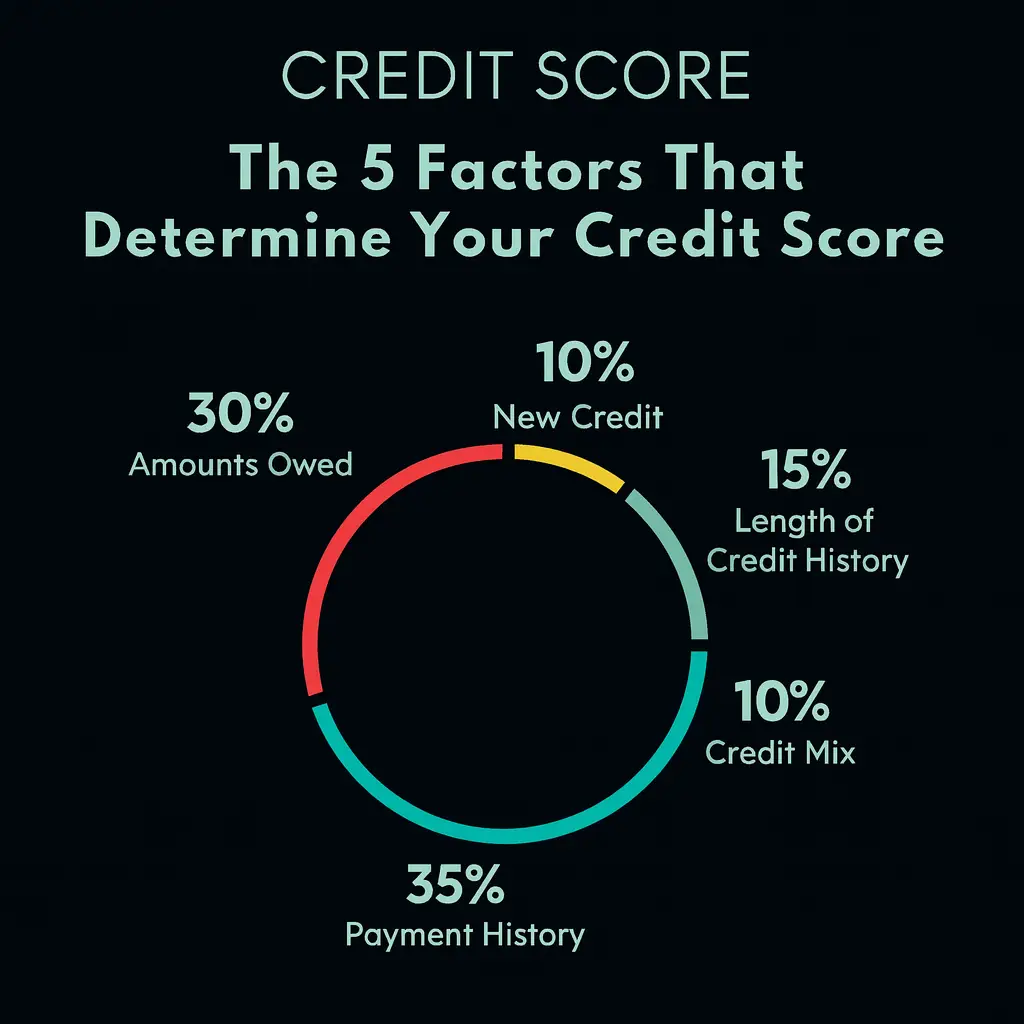

As a mortgage specialist serving North County San Diego, one of the common questions I hear is, “What exactly goes into my credit score?” and “How can I improve it before applying for a home loan?” Your credit score plays a major role in determining your loan options, interest rate, and overall affordability. The […]